The KiwiSaver scheme with real choice

Invest your KiwiSaver balance and ongoing contributions in the companies and exchange-traded funds (ETFs) that matter to you most. It’s your money, your future. Make it yours!

Make it uniquely you

Reflect what matters to you in your KiwiSaver portfolio, with over 150 NZ and US-listed companies and exchange-traded funds (ETFs) to pick from.

You call the shots

Change your picks or base fund mix, whenever works best for you, wherever you’re at in life. After all, you know you better than anyone else.

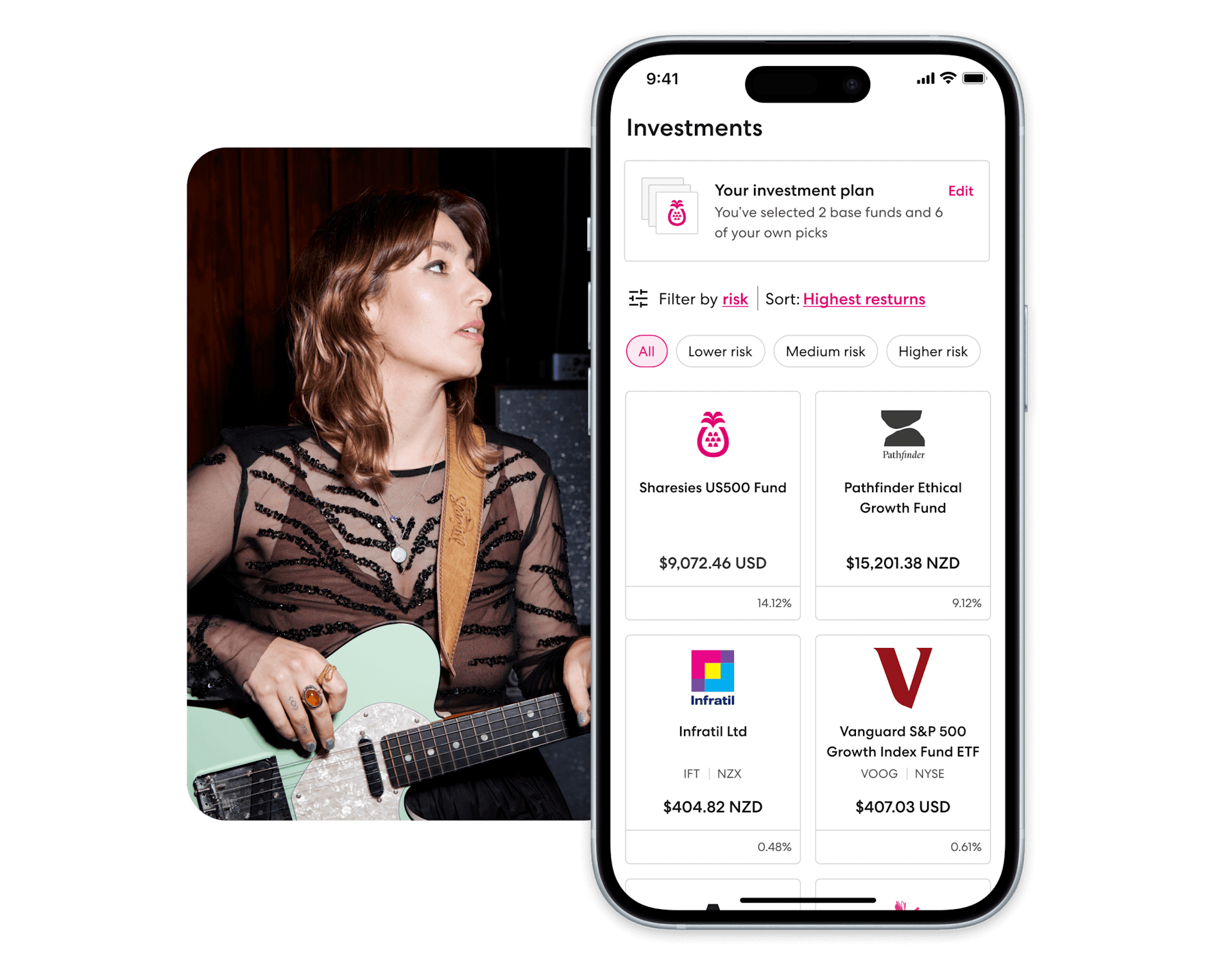

See where every dollar goes

Experience a more transparent KiwiSaver portfolio, with in-depth info about your investments, returns, and transactions.

Voluntary contributions made easy

Top up your KiwiSaver balance with voluntary contributions—straight from your Sharesies Wallet.

Available now

US Markets

Broaden your horizons with the Sharesies US500 Fund, and take your pick from over 50 US companies and ETFs with US self-select.

How the Sharesies KiwiSaver Scheme works

Unlike conventional KiwiSaver schemes, our Scheme gives you the freedom to choose your own investments, with tools and limits to help you manage your portfolio’s risk and diversification.

Start with a plan

Your first step is making an investment plan. It tells us how you’d like your KiwiSaver balance and ongoing contributions invested.

Choose a base fund

You have seven base funds to choose from, ranging from conservative to high growth. Select a single base fund for your entire investment plan, or select multiple base funds for even greater diversification.

Add your own picks

If you like, you can add your own choice of over 150 companies and ETFs listed on NZ and US exchanges. Up to half of your plan can be allocated to your picks, to a max of 5% in each pick.

Change as your life changes

Goals, values, or risk appetite change? No worries—you can change your base funds, or your picks, whenever you like.

Ready to join?

Joining takes just minutes if you’ve got a Sharesies account and you’re over 18.

Don’t have a Sharesies account? Sign up now

Have a go at making a plan

See what an investment plan that’s as unique as you are could look like. Then, if you’re keen, use it to join straight away—or save it for later.

- Agriculture and fisheries

- Banking and finance

- Bonds and fixed income

- Crypto

- Energy and utilities

- Food and drink

- Healthcare

- Index funds

- Infrastructure

- Manufacturing

- Media

- Mining, oil and gas

- Property

- Responsible

- Retail

- Services

- Strategic funds

- Technology

- Tourism

- Transport

Fees

Your fees will flex based on what you pick, and how much you personalise your portfolio.

Documents

Product disclosure statement (PDS), fund updates, reports, statements, and policies.

Tax

We’ll report and pay tax at your prescribed investor rate (PIR) for you. You don’t need to lift a finger!

How to join

You’ll need to have a Sharesies account and be over 18. If you don’t already have an account, sign up now.

- Answer a couple of questions

We’ll ask what you’re planning to use your KiwiSaver balance for, and the kind of funds you’re interested in.

- Make your investment plan

Choose a base fund then, if you like, add additional base funds and self-select investments.

- We’ll take it from there!

It’ll take us about 10 days to transfer your KiwiSaver account, or about five days to get you set up if you’re new to KiwiSaver.

The Payoff

Over six, 20-minute episodes, we bust KiwiSaver myths and get expert tips from Simran Kaur, Mary Holm, Brad Olsen, Petra Bagust, and Pio Terei.

More good stuff on the way

More you, with new self-select investments—including Australian shares

More choice, with a greater variety of base funds, and a multi-currency cash fund

More control, with direct voluntary contributions straight from wallet

Learn more about KiwiSaver

From getting started to using it for your first home—and beyond!

Your future in one place

Experience a new level of connection with your investments, savings, and KiwiSaver account. Developing your wealth has never felt so personal.

Now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Sharesies Investment Management Limited is the issuer of the Sharesies KiwiSaver Scheme. The product disclosure statement (PDS) for the Sharesies KiwiSaver Scheme has been lodged, and may be viewed on the Disclose Register or on our documents page.