Pricing

The one place to find fees for investing and saving with Sharesies, and for the Sharesies KiwiSaver Scheme.

Keep it casual, or keep it regular

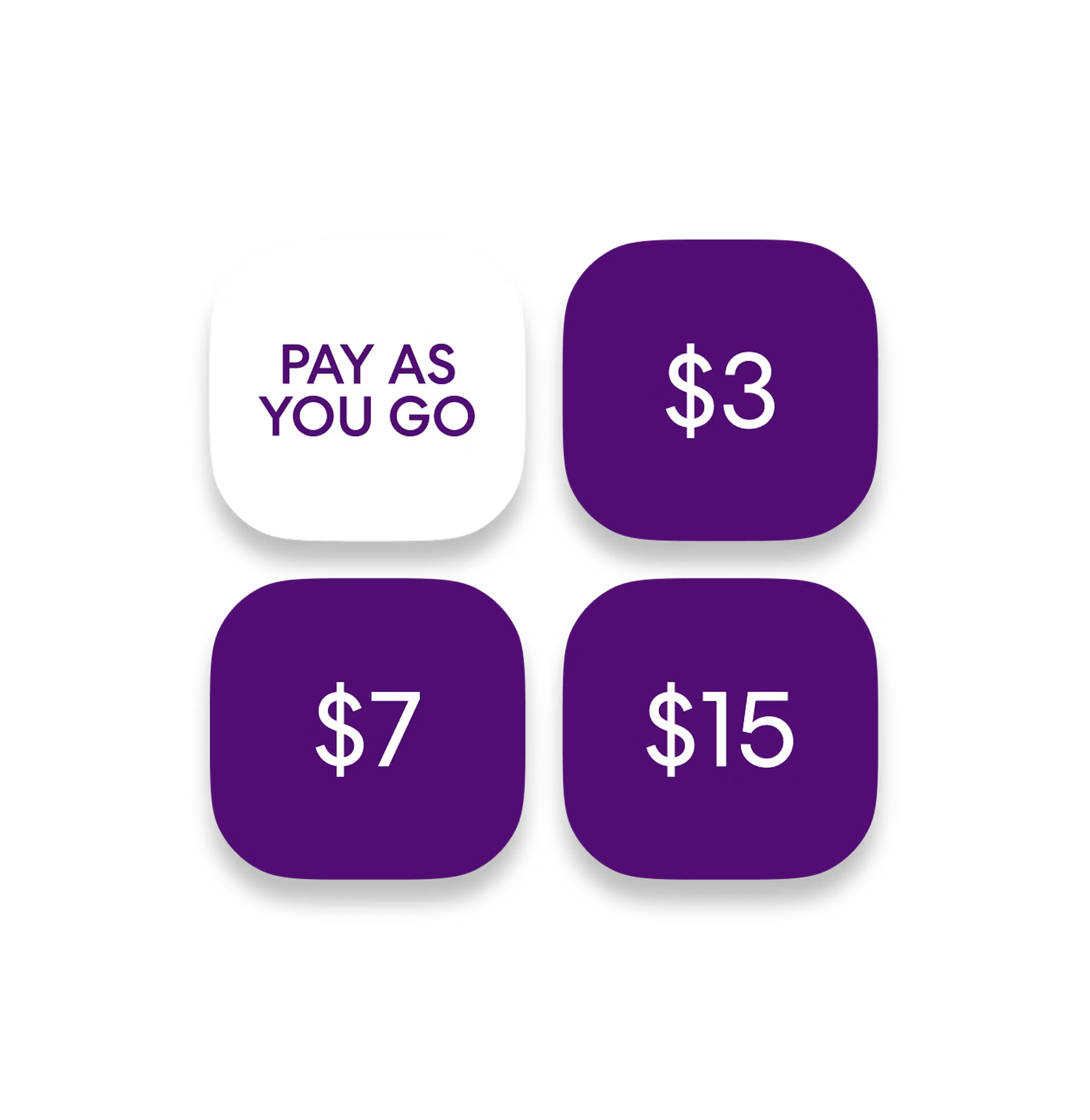

Invest when the timing is right with pay as you go, or get your transaction fees and other inclusions covered with a plan.

Pay as you go

No monthly or annual feeDip a toe in the market, or make the most of capped fees on larger orders

Each time you buy or sell shares, there’s a 1.9% transaction fee on the amount invested (or sold), up to a fee cap.

Transaction fees capped at

- $5 USD for US shares

- $15 AUD for Aussie shares

- $25 NZD for NZ shares

There’s no transaction fee on orders for managed funds (funds not listed on an exchange).

Plus, you get access to a bunch of Sharesies’ features.

Plans for the kids

With a plan just for Kids Accounts, as well as access to the $7 plan and $15 plan, it’s easy to help a kid in your life build an investing habit that lasts a lifetime.

$1

kids plan

Per month, charged monthlyGive a kid in your life a head-start on investing

On a kids plan, transaction fees are covered on a set amount of buy, sell, and auto-invest orders across US, NZ, and Australian shares.

Transaction fees covered on:

- $500 NZD of buy and sell orders, and

- $1,000 NZD of auto-invest orders

Compare plans

| Pay as you go | $3 plan | $7 plan | $15 plan | |

|---|---|---|---|---|

| Plan fee | No monthly or annual fee | $3 NZD per month, or $32.40 annually | $7 NZD per month, or $75.60 annually | $15 NZD per month, or $162 annually |

| Buy and sell orders | 1.9% transaction fee, up to the | $500 NZD of orders with transaction fees covered per month | $1,000 NZD of orders with transaction fees covered per month | $5,000 NZD of orders with transaction fees covered per month |

| Auto-invest orders | 1.9% transaction fee, up to the | $1,000 NZD of orders with transaction fees covered per month | $3,000 NZD of orders with transaction fees covered per month | $10,000 NZD of orders with transaction fees covered per month |

| Managed fund orders | No Sharesies transaction fee | No Sharesies transaction fee | No Sharesies transaction fee | No Sharesies transaction fee |

| NZX market depth | - | - | - | Yes |

| US live pricing | - | - | - | Yes |

| Airpoints Dollars™ | - | - | Earn 1 Airpoints Dollar™ for every $1k worth of net top-ups or transfers each calendar month | Earn 1 Airpoints Dollar™ for every $1k worth of net top-ups or transfers each calendar month |

Features for everyone, no matter what

No minimum investment

Auto-invest (with one-off buys)

Limit orders

Stop loss orders

Trigger buy orders

Watchlist

Price notifications

Auto-invest dividends

Voting for NZ companies

Extended US trading hours

Savings account with no fees and no limits

Share transfers for US, NZ, and Aussie shares

How we compare

| Amount to invest (NZD) | Sharesies | ASB Securities | Craigs IP | Hatch | Stake | Superhero | Tiger Brokers |

|---|---|---|---|---|---|---|---|

| $5 | $0.10 | $15.00 | $75.00 | Not offered | Not offered | Not offered | $4.00 |

| $50 | $0.95 | $15.00 | $75.00 | Not offered | Not offered | Not offered | $4.00 |

| $100 | $1.90 | $15.00 | $75.00 | Not offered | Not offered | Not offered | $4.00 |

| $200 | $3.80 | $15.00 | $75.00 | Not offered | Not offered | Not offered | $4.00 |

| $500 | $9.50 | $15.00 | $75.00 | Not offered | Not offered | Not offered | $4.00 |

| $1,000 | $19.00 | $15.00 | $75.00 | Not offered | Not offered | Not offered | $4.00 |

| $10,000 | $25.00 | $30.00 | $125.00 | Not offered | Not offered | Not offered | $30.00 |

| $25,000 | $25.00 | $75.00 | $312.50 | Not offered | Not offered | Not offered | $75.00 |

Updated 5 June 2025. Fee amounts are for a single order in displayed currency, and include transaction and currency exchange fees from an NZD deposit—other fees may apply. Sharesies pricing is compared against competitors’ standard pricing accessed from their websites. For the most up-to-date competitor info, visit their websites. On Sharesies, top-ups and withdrawals can only be made in NZD.

How things work around here

All the details on plans, how transaction fees are calculated, and other fees you might be charged.

Plans

If you choose a plan, your coverage will start straight away and automatically renew at 12:01 AM on the same day each month.

If your plan starts on the 29th, 30th, or 31st of a month, your coverage will instead renew on the first day of the month after next. It’ll then continue to renew on the first day of each following month.

You can upgrade, downgrade, or cancel your plan at any time.

If you upgrade your plan, it’ll switch straight away. If you’re on a monthly plan, you’ll be charged the difference in plan fee. If you’re on an annual plan, you’ll be charged your new plan fee minus any value remaining on your current plan.

Downgrading or cancelling your plan will happen when your active plan ends.

When you’re on a plan, you get transaction fees covered up to a set amount for individual buy and sell orders, and a separate amount covered for auto-invest orders—that’s your plan’s coverage. Coverage renews every month, regardless of whether you’ve chosen to pay for a plan monthly or annually.

When you place a buy or auto-invest order, we’ll calculate the highest amount it could fill at, and look to deduct the equivalent amount from your available coverage. We might deduct less if your order amount is higher than the amount of coverage you have left.

Once your coverage is used up, the 1.9% transaction fee (and per order fee caps) apply to all orders until your plan renews.

Coverage is deducted from the plan that’s active at the time an order was placed. While your order is pending, the deducted coverage amount won’t be used for any other orders.

If you’ve already got an order on-market when you start a plan, it won’t be covered by your plan. Instead, the 1.9% transaction fee (and per order fee caps) will apply.

Orders in USD or AUD

We work out how much to deduct from your coverage by converting your order amount to NZD, and deduct the equivalent NZD amount of coverage. This happens at the time you place your order.

Returning coverage

We might return some (or all) of the deducted coverage amount when your order:

fills—if the amount we deducted isn’t fully used when your order fills, we’ll return the leftover amount to your coverage

expires—the amount we deducted for the expired part of your order will be returned to your coverage

is cancelled—the amount we deducted for the cancelled part of your order will be returned to your coverage.

Any returned amounts will go back to the coverage for the month they originally came from. If that month has passed, you won’t receive that coverage amount back.

If we’re returning coverage from an order in USD or AUD to you, we’ll convert the coverage amount at the time we make the return.

If you have coverage returned to you during the month of your plan, you’ll be able to use it until your plan renews.

Example: Coverage returned from buy order to previous month

You place a $100 buy order, and we deduct $100 from your available coverage. Part of your order fills for $80, while the remaining $20 of your order stays on-market.

After 30 days, your plan has renewed, and the remaining $20 of your order is still unfilled and is cancelled. We return $20 of coverage to the previous month of your plan, but because that month has now passed, it can’t be used.

Sell orders are deducted from any available coverage as they fill (which might happen in parts, and over multiple trades). For sell orders that fill after you’ve used up your coverage, the 1.9% transaction fee (and per order fee caps) will apply until your plan renews.

If your plan renews while you’ve got a sell order on-market, we’ll look to use any available coverage from the plan that was active when you placed your order. For any part that isn’t covered, the 1.9% transaction fee (and per order fee caps) will apply.

If you start a plan while you’ve got a sell order on-market, the 1.9% transaction fee (and per order fee caps) will apply.

Example: Sell order filling over two trades

On the day before your plan renews, you place a sell order that goes on to fill over two $50 trades (for $100 total). The first $50 trade fills that day, and $50 is deducted from your coverage. The remaining part of your order stays on-market.

The following day, your plan renews and the remaining part of your order fills for $50. If you’ve still got coverage available from the previous month of your plan, it’ll be used for the remaining $50 of your order. If you’ve used up all of your coverage from the previous month, the 1.9% transaction fee (and per order fee caps) will apply.

A partial coverage order is when some of your order uses your remaining available coverage, and the rest is charged the 1.9% transaction fee (and per order fee caps). This can happen when your order amount is higher than your remaining coverage.

Partial order that hits fee cap

If the part of your partial order charged the 1.9% transaction fee reaches a fee cap, we’ll return any coverage that would’ve otherwise been used, and charge the capped fee amount.

Example: Partially covered buy order

You place a $100 buy order, but you only have $50 of available coverage.

We’ll use the $50 of your available coverage first, and charge a transaction fee on the remaining amount to invest (1.9% × $49.07 = $0.93).

That means the total amount to invest will be $99.07, and you’ll be charged a transaction fee of $0.93.

Example: Partial order that hits fee cap

You place a $2,000 buy order for NZ shares, but you only have $100 of available coverage.

We’ll look to use the $100 of available coverage first, giving a remaining order amount of $1,900.

A 1.9% transaction fee applied to $1,900 would work out to be $35.43 ($1,864.57 x 1.9%). But, because this hits the $25 per order fee cap for NZ shares, we’ll return the $100 coverage that would’ve been used, and instead charge a $25 transaction fee and $1,975 is invested.

Coverage examples are in NZ dollars (NZD).

Your plan fee will be charged to your chosen payment method (either your Sharesies Wallet or debit or credit card) based on your plan frequency (monthly or annual) at 12:01 AM on the day.

If your chosen payment method is a debit or credit card and your payment fails, we'll try again (if you're paying monthly) or cancel your plan (if you're paying annually, or if your monthly payment fails a second time).

If your chosen payment method is your Wallet and you don’t have enough NZD in your Wallet to cover your plan fee, your Wallet balance may go into negative. If you’re not able to pay your plan fee for two months in a row, your plan won’t renew the second time (and the 1.9% transaction fee (and per order fee caps) will apply to all orders).

The plan fee only covers transaction fees on the orders you place within your coverage balance. It doesn’t cover other fees such as currency exchange fees, or card top-up fees.

How we calculate transaction fees

For market orders, limit orders, and trigger buy orders placed in dollars, the transaction fee is calculated on the amount to invest (the net amount) and deducted from the order amount you enter (the gross amount).

Your transaction fee won’t be higher than the capped fee amount per order for each market.

Example: Buy order below fee cap

If you place a $100 buy order, the amount that’ll be invested ($98.14) is used to calculate the transaction fee amount ($98.14 x 1.9% = $1.86), which is deducted from your order amount ($100 - $1.86 = $98.14).

Example: Buy order above fee cap

If you place a $1,500 buy order for NZ shares, a 1.9% transaction fee would work out to be $27.97 ($1472.03 x 1.9%). But, because the capped fee amount for NZ shares is $25 per order, you’re only charged a $25 transaction fee and the amount invested is $1,475.

Fee examples are in NZ dollars (NZD).

For limit buy orders in whole or fractional shares, the transaction fee is calculated on the amount to invest (the net amount). You set the amount to invest by selecting the highest price to pay per share and the number of shares to buy.

The order amount you’re charged is the amount to invest plus the transaction fee. Your transaction fee won’t be higher than the capped fee amount per order for each market.

When you place a limit buy in shares, an estimated fee amount is shown. When your order fills, the fee is recalculated on the actual amount invested.

Example: Limit buy order below fee cap

If you place a limit buy order, your amount to invest will be $100 at most if you set:

the highest price to pay per share at $10, and

the number of whole shares to buy at 10.

From the amount to invest, a $1.90 transaction fee (1.9% × $100 = $1.90) is calculated and your total order amount is estimated to be $101.90.

Example: Limit buy order above fee cap

If you place a limit buy for US shares, your amount to invest will be $500 USD at most if you set:

the highest price to pay per share at $10 USD, and

the number of whole shares to buy at 50.

A 1.9% transaction fee applied to the amount to invest ($500 USD) would work out to be $9.50 USD (1.9% × $500 USD = $9.50 USD). But, because the capped fee amount for US shares is $5 USD per order, you’re only charged a $5 USD transaction fee and your total order amount is estimated to be $505 USD.

Fee examples are in NZ dollars (NZD) unless otherwise specified.

For market sell orders, you set the number of shares to sell, and we calculate an estimated order amount using the estimated market price (for stop loss orders, we calculate an estimated order amount using the price you set to trigger a sell order). From the estimated order amount, we calculate an estimated transaction fee on the estimated amount you’ll receive.

When your order fills, the fee is recalculated on the actual amount you receive, and deducted from the sell order amount before it reaches your Wallet. Your transaction fee won’t be higher than the capped fee amount per order for each market.

Example: Market sell order below fee cap

If you place a sell order for 10 shares with an estimated market price of $10 per share, your estimated order amount will be $100.

From the estimated $100 order amount, we calculate an estimated $1.86 transaction fee on the estimated $98.14 amount you’ll receive ($1.86 = 1.9% × $98.14).

Example: Market sell order above fee cap

If you place a sell order for 150 NZ shares with an estimated market price of $10 per share, your estimated order amount will be $1,500.

From the estimated $1,500 order amount, a 1.9% transaction fee calculated on the estimated $1,472.03 amount to receive would work out to be $27.97 (1.9% × $1,472.03 = $27.97). But, because the capped fee amount for NZ shares is $25, you’d only be charged a $25 transaction fee and the estimated amount received is $1,475.

Fee examples are in NZ dollars (NZD).

For limit sell orders, you set the number of shares to sell and the lowest price to sell per share—this gives you an estimated order amount. From the estimated order amount, we calculate an estimated transaction fee on the estimated amount you’ll receive.

Example: Limit sell order below fee cap

If you place a limit sell order, your estimated order amount will be $100 if you set:

the number of whole shares to sell at 10, and

the lowest price to sell per share at $10.

From the estimated $100 order amount, we calculate an estimated $1.86 transaction fee on the estimated $98.14 amount you’ll receive ($1.86 = 1.9% × $98.14).

When your order fills, the fee is recalculated on the actual amount you receive, and deducted from the sell order amount before it reaches your Wallet. Your transaction fee won’t be higher than the capped fee amount per order for each market.

Example: Limit sell order above fee cap

If you place a limit sell order for NZ shares, your order amount will be $1,500 at most if you set:

the lowest price to sell per share at $10, and

the number of whole shares to sell at 150.

A 1.9% transaction fee applied to the estimated amount to receive ($1472.03) would work out to be $27.97 (1.9% × $1472.03 = $27.97). But, because the capped fee amount for NZ shares is $25, you’re only charged a $25 transaction fee and your total estimated amount to receive is $1,475.

When your order fills, the fee is recalculated on the actual amount you receive, and deducted from the sell order amount before it reaches your Wallet. Your transaction fee won’t be higher than the capped fee amount per order for each market.

Fee examples are in NZ dollars (NZD).

Other fees you might be charged

You’re charged a 0.5% currency exchange fee when you exchange money.

The fee is calculated on the amount to exchange, and deducted from the amount you enter.

You can exchange money in Sharesies any time you like, or during the buy or sell process.

When you invest in an ETF or managed fund, you’re charged a management fee. This is charged by the fund provider—not Sharesies—and included in the unit price.

The fee pays for the fund’s management, distribution, and operational costs.

The management fee is different for each fund, so check the fund info before you invest.

Orders for managed funds (funds not listed on an exchange) aren’t charged our transaction fee. But, we do charge the managed fund provider a fee, which you can expect to make up some part of the management fee they charge.

Managed funds may charge a transaction fee when you buy and sell units. This is also known as a ‘spread fee’.

The fee is added to the price when you buy, and deducted from the price when you sell. This is charged by the fund, not Sharesies.

When you invest in an American depositary receipt (ADR), you may be charged depositary fees. These are charged by the depositary bank that issued the ADR, not Sharesies.

The fees cover the depositary bank’s costs for managing the ADR, and are based on how many receipts you hold. Generally, the fee is less than $0.10 USD per receipt annually.

The depositary fee can be charged a couple of ways:

if the ADR pays dividends, the fee will be deducted from any dividends on the ex-dividend date before they’re paid into your Wallet

if the ADR doesn’t pay dividends, the fee will usually be deducted from your Wallet balance during the year.

Sometimes, it could be a mix of both—part of the fee deducted from your dividends and the rest deducted from your Wallet during the year.

Each time you make an instant bank transfer, you’re charged a transfer fee. This fee will be 0.95% of the value of the transfer—up to a maximum amount of $3 per transfer.

If you use an instant bank transfer for your first ever Wallet top-up, your transfer fee will be covered.

You’re not charged this transfer fee for regular bank transfers, but the money might take a bit longer to appear in your Wallet.

You’re charged a card processing fee when you top up a Sharesies Wallet, buy a Sharesies Gift, or pay for a plan with a debit card, credit card, Apple Pay, or Google Pay.

This fee is calculated on the amount you enter to top up or buy. You’ll see how much the fee will be before you confirm your order.

If you use a card for your first ever Wallet top up by card (for an amount up to $100 NZD), your card processing fee will be covered.

When you transfer shares, you may be charged a fee depending on the type of transfer you make.

NZ shares

To transfer shares listed on the New Zealand Stock Exchange (NZX) into Sharesies, we don’t charge a fee.

To transfer NZX-listed shares out of Sharesies, it costs $15 NZD per investment you transfer.

Australian shares

To transfer shares listed on the Australian Securities Exchange (ASX) into Sharesies, we don’t charge a fee.

To transfer ASX-listed shares out of Sharesies, it costs $50 NZD per investment you transfer.

US shares

To transfer US shares into Sharesies, we don’t charge a fee.

Fees for US share transfers out

DriveWealth partner transfer

For share transfers from Sharesies to another DriveWealth partner (for example, Hatch or Stake), you’re charged per transfer request. Our share transfer fee is $100 USD to transfer out of Sharesies. You can transfer any number of investments within a request.

Depository Trust Company (DTC) transfer

For share transfers from Sharesies to a broker that isn’t a DriveWealth partner, our share transfer fee is $50 USD per investment you transfer within a request.

Direct Registration System (DRS) transfer

For share transfers from Sharesies to transfer agent (for example, Computershare or Equiniti), our share transfer fee is $100 USD per investment. Only one investment may be transferred in each request.

Account-to-account transfers

There’s a fee for transferring shares from one NZ Sharesies account to another NZ Sharesies account. It costs $50 NZD to transfer up to 25 investments, then $2 NZD for each additional investment in the share transfer request after the first 25.

When you request to withdraw money that hasn’t settled, you have the option to pay a fee to receive your withdrawal in one business day.

The fee is 1.9% of the unsettled amount, and is deducted from your total withdrawal amount.

For example, if you request to withdraw $500 and $200 of that is unsettled, you could pay a $3.80 fee (1.9% of $200) to receive your withdrawal faster. The withdrawal amount you’d receive in your bank account would be $496.20 ($500 minus the $3.80 faster withdrawal fee).

A $15 NZD account closure fee may be charged (or deducted from the remaining Wallet balance, if less) if your account is closed because:

it hasn’t complied with our anti-money laundering and countering financing of terrorism (AML-CFT) obligations

other inappropriate behaviour.

How Sharesies makes money

You pay us the fees described on this page, and we also earn:

interest from any money in your Wallet

commission on money in Save accounts—it’s the difference between the interest rate you earn and the interest rate we receive from the bank where the money is held

fees from fund providers if they pay us to have their funds on Sharesies

revenue from Cove for insurance policies bought through Sharesies

fees from companies to distribute info or offers (such as capital raises), or for providing services (such as Staff Shares and Sharesies Open)

money from external relationships.

Your future in one place

Experience a new level of connection with your investments, savings, and KiwiSaver account. Developing your wealth has never felt so personal.