Investing Insights with Tony Alexander: Has inflation peaked?

Each quarter, Tony surveys more than 30,000 Kiwis to find out what they’re investing in, how they’re investing, what they're selling, and what’s been on their minds. He then looks at how these preferences are changing over time and why.

Below, we look at some of the key trends in Tony’s May survey.

Staying on course

Investors are still buying shares despite concerns about the US banking sector and rising interest rates. Survey respondents looking to add to their investments in the coming year only dipped slightly to 72.8% from 73.3% three months ago.

This result comes as a bit of a surprise considering there have been some large fluctuations in offshore markets following the Silicon Valley Bank collapse in March, and subsequent questions about the stability of the US banking system. Also, here in NZ, the official cash rate (which influences bank interest rates) was hiked 0.5% in early April to 5.25%.

But what may explain why investors are still willing to invest, is a lower than expected 6.7% rise in inflation released later in April.

Shares take the lead

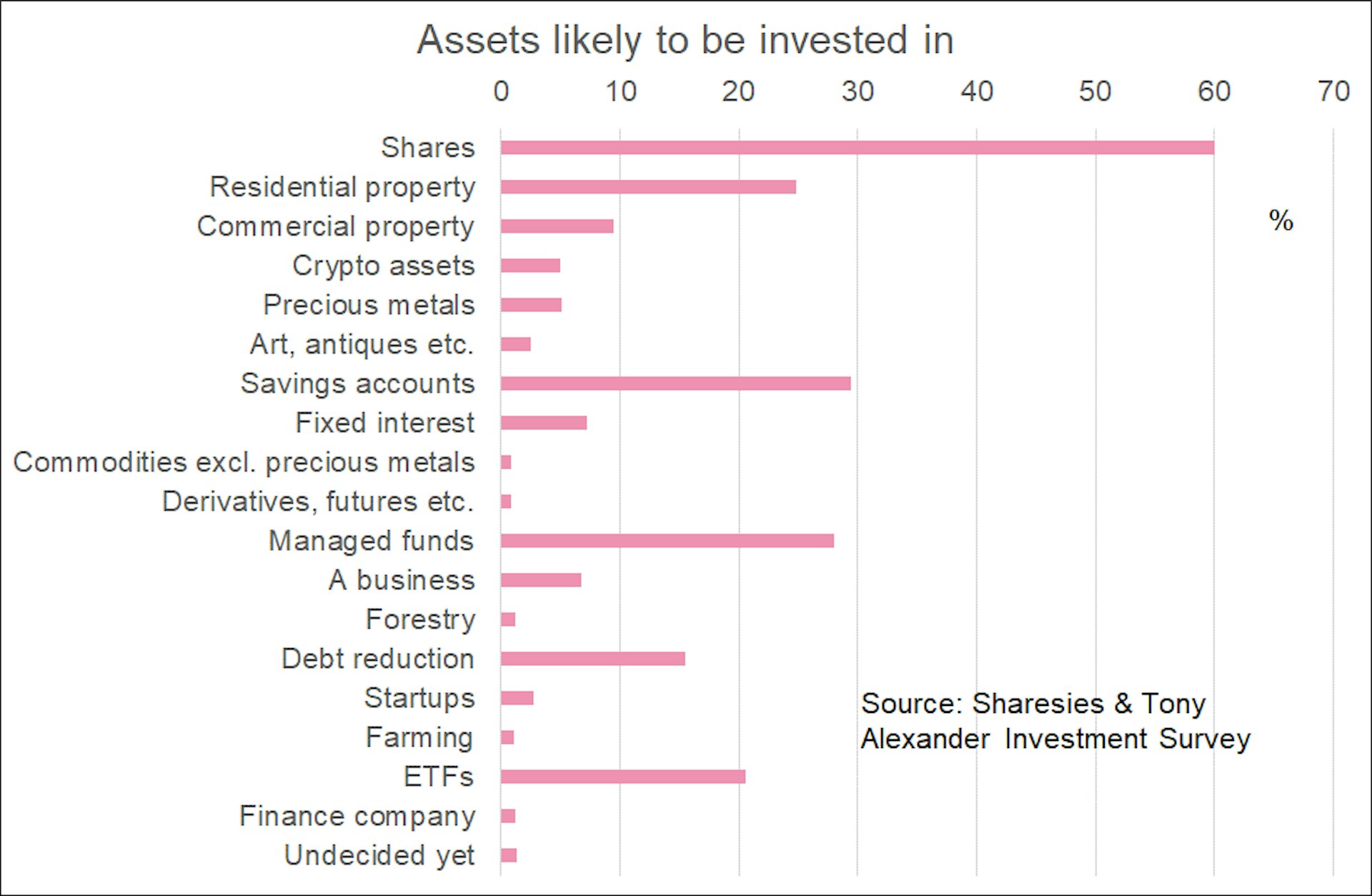

Shares are the preferred investment with 60% of investors looking to buy more. Notably in second place, 29% of respondents are looking to build up their savings account deposits. This is followed closely by 28% looking to invest in managed funds, and residential property comes in fourth with 25% of respondents looking to invest in housing.

Of the assets investors are thinking of selling, residential property is the first choice, followed very closely by shares. There’s likely more to this comparison than meets the eye—selling shares can be accomplished in a few seconds while selling an investment property can take over a month and a half at the moment.

A slight change is that the intent to buy residential investment property has increased this quarter, though it is still relatively low—even when compared with the most rapid period of price decline through 2022. This may reflect the migration boom and ‘encouraging talk’ that the housing market has almost bottomed.

High-interest rates 🤝 savings

Interest in buying crypto assets is up a little, possibly due to the bounce in cryptocurrency prices around the time of the US banking sector concerns.

There has been a slight increase in plans to buy precious metal—perhaps in line with gold prices going above $2,000 USD an ounce for a time recently.

But the biggest shift in buying intentions is for bank term deposits, which reached a record high for the survey. Rising interest rates are fuelling this trend. People are putting money aside—the question is when will they choose to allocate it to other types of investments?

Apps beat brokers

Using an app—such as Sharesies—remains the preferred way to buy shares over using a broker, at 53% of respondents. This is as high as it’s been since the survey started in January 2022.

What’s worrying investors?

The top concern on investors’ minds is whether interest rates will keep rising. A concern that may intensify given the Government predicted in its Budget 2023 update that interest rates are likely to stay higher for longer.

This is followed by concerns around inflation, which produces high-interest rates and compresses people’s spending power. High inflation also makes business planning difficult and can eat into profits.

The third investor concern is return on investments. This relates to the current outlook for the world economy and geopolitics relating to China and the war in Ukraine. Recession worries are also high but may ease now the Treasury is no longer predicting a recession.

Download the report

For a deeper dive, download the full Investing Insights report for May 2023 [PDF, 1.44 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 860,000 investors