Investing Insights with Tony Alexander: Investors are cautiously optimistic

Every three months, Tony surveys more than 30,000 Kiwis to find out what they’re investing in, how they’re investing, what they're selling, and what’s been on their minds. He then looks at how these preferences are changing over time and why.

Below, we look at some of the key trends from Tony’s May survey.

In it for the long haul

The percentage of survey respondents who say they intend to contribute to their portfolio this year remains firm at 75%. While slightly down from 78% last quarter, this indicates that despite troubled times overseas, and wobbles in consumer and business sentiment locally, investors are still focused on the long term.

Buying shares remains the most popular type of investment. This is followed by investing in managed funds and exchange-traded funds (ETFs), as well as allocating money to saving and debt.

Property slump continues

Survey respondents intending to buy residential property sits at just 4%, compared to 11% a year ago and a peak of 17% in September 2022.

The desire to hold commercial property has also been trending down—but over a longer period. This likely reflects the combined impact of rising and higher interest rates, and revaluations of assets trending downward.

Smaller appetite for savings

During uncertain economic times in earlier surveys, we saw a firm rise in respondents intending to allocate spare money to savings accounts. This trend has eased over the past two quarters, suggesting there are better returns to be made elsewhere. The soaring markets in the US could be a factor in this.

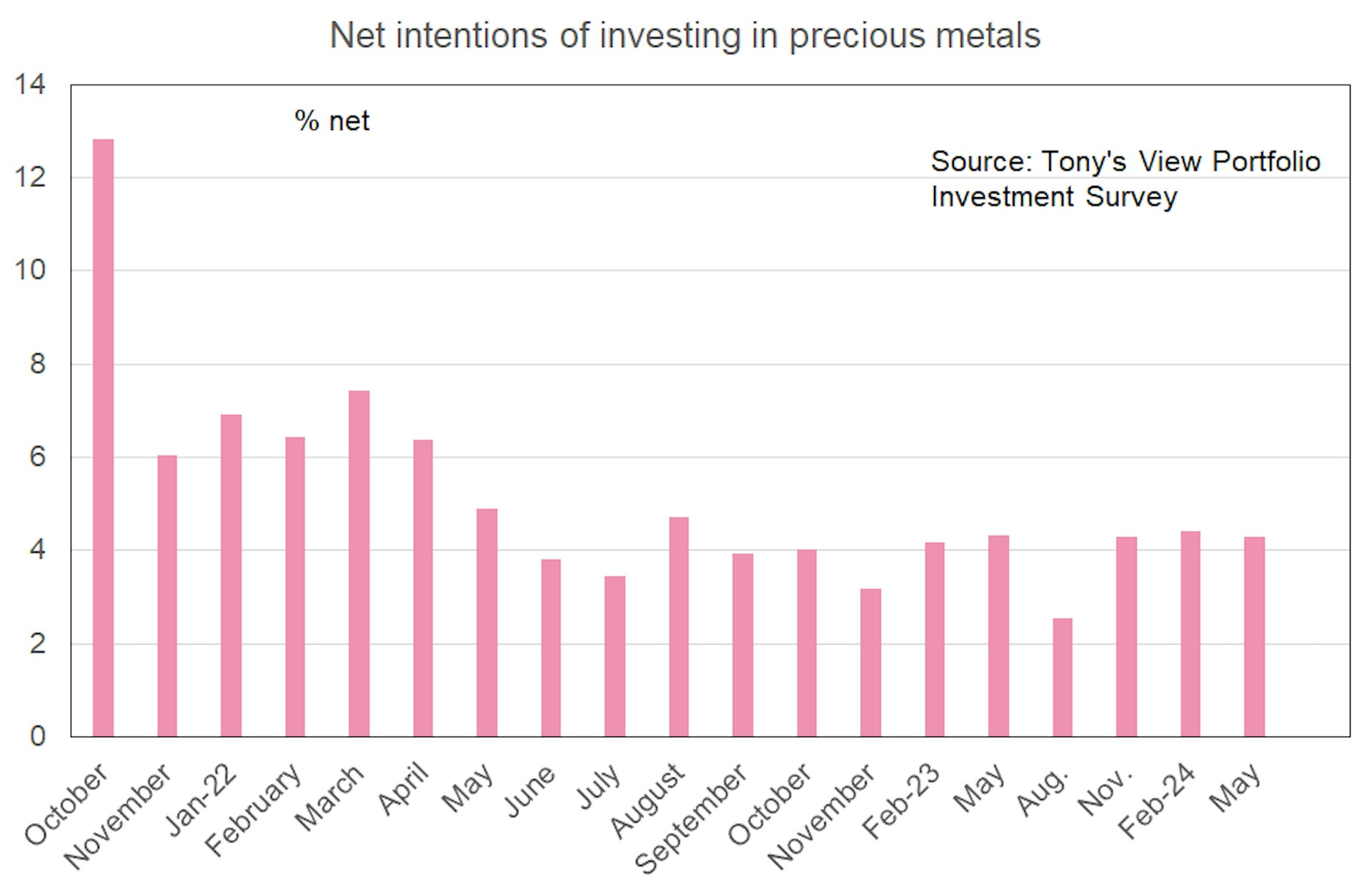

Precious metals fail to shine

Despite the price of gold and copper (common safe havens in tough economic times) reaching record highs recently, survey respondents showed only mild interest in investing in precious metals.

Download the report

For a deeper dive, download the full Investing Insights report.

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 800,000 investors