Investing Insights with Tony Alexander: Investors are more cautious

In June's report, independent economist Tony Alexander finds that while pulling back, investors are reshuffling portfolios rather than selling.

Each month, Tony surveys over 28,000 Kiwis to find out what they’re investing in and how they’re investing in it. He then analyses their responses and reports on how investment preferences are changing over time. This gives us a look into people’s thoughts on different shares, types of property, active vs passive fund management, whether to use an advisor or an app, which countries to invest in, and much more.

Below, we look at some of the key trends in Tony’s June 2022 survey.

Investors start to pull back

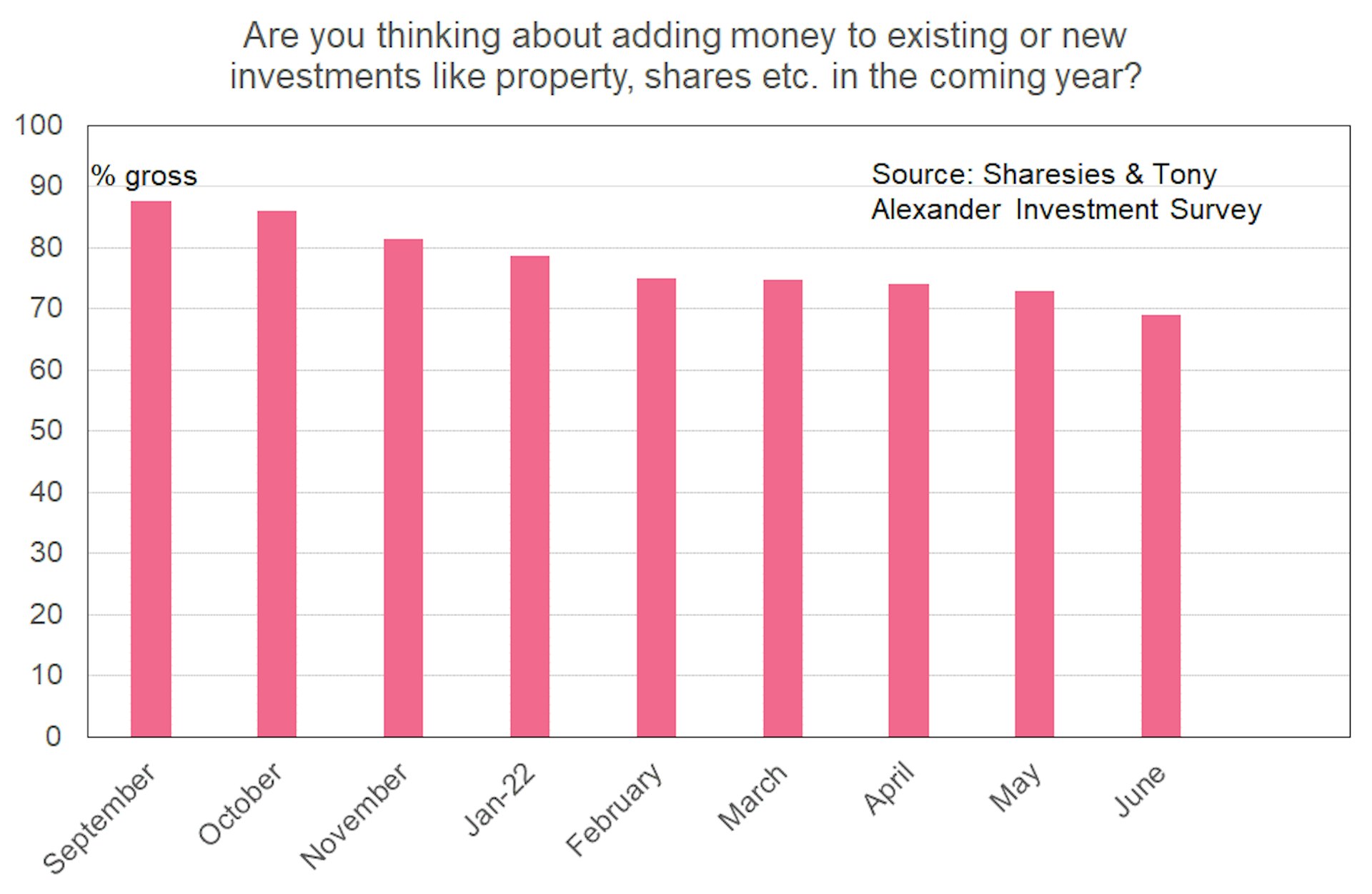

No prizes for guessing that among investors, there’s less appetite to add to portfolios.

While market weakness has affected investment planning, there are other reasons people may be pulling back. These include the 6.9% hike in the cost of living over the past year, rising interest rates diverting income to pay off debt, and uncertainty about the New Zealand and world economies.

Results from this month's survey show those still willing to invest is down to 69% of respondents. A slight dip compared to 73% last month, but a 10 point fall from 79% in February and 88% in September.

Holding shares and crypto

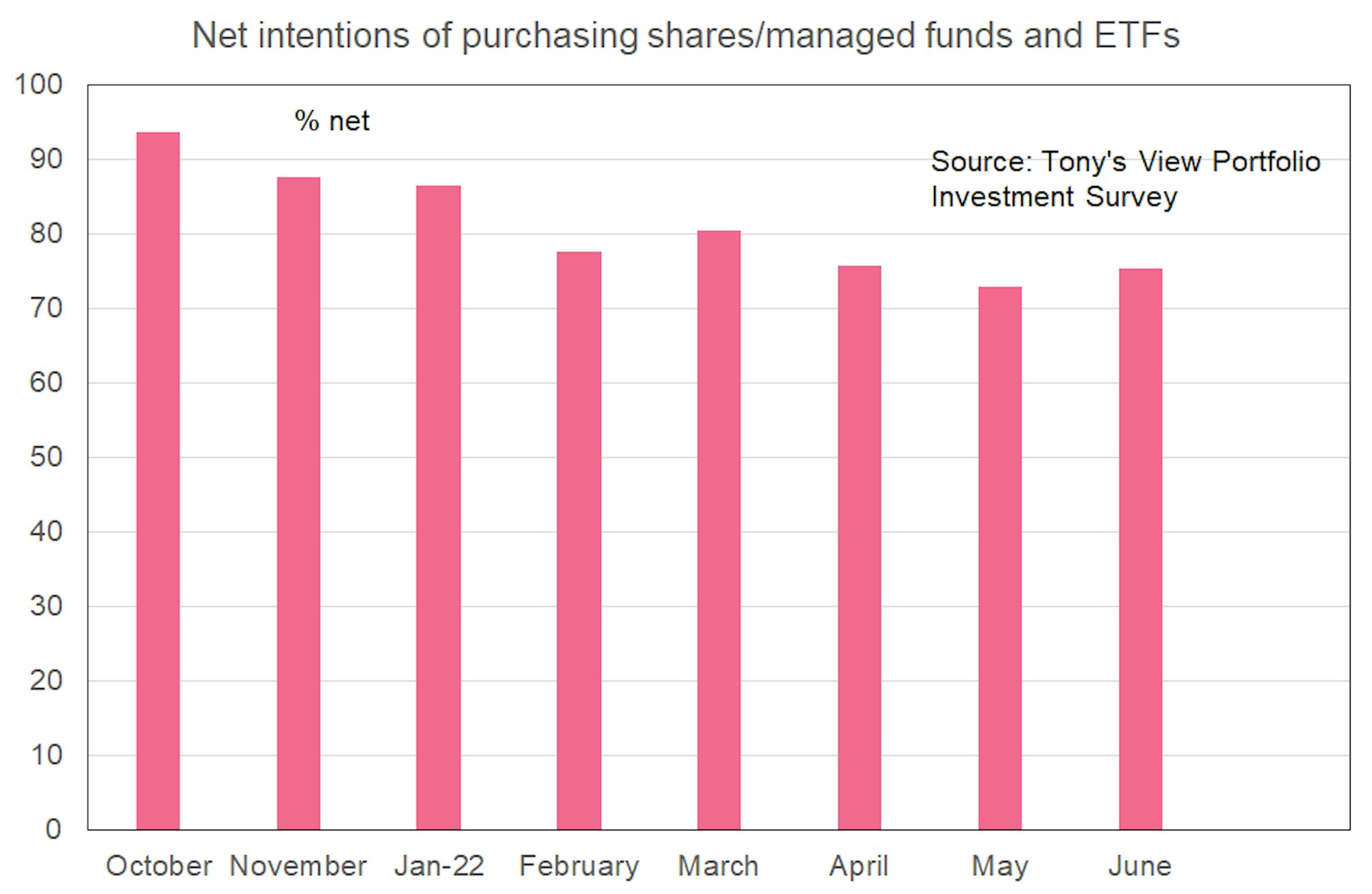

Shares bought directly or through a managed fund or ETF (exchange-traded fund) remain the favourite portfolio investment choice.

As with last month, residential property is the first asset class people are selling.

Despite sharp crypto price falls, we aren't seeing people bailing out of crypto.

Reshuffle rather than sell

When offsetting the buy and sell data from respondents, the net buying intent for shares (including managed funds and ETFs) has actually firmed in the month. This tells us something important—market turbulence is mainly causing some portfolio reshuffling of shares, rather than outright net selling.

Tried and true sectors

Energy, finance, and health are still the most popular sectors in the six months since we started our survey.

Soaring international energy prices continue to encourage a preference for this sector.

But woeful times in residential construction are having an impact on demand for shares specifically exposed to the residential property sector.

More balanced

While growth funds remain popular, there’s a slight shift for the first time to balanced funds. No doubt, extra uncertainty and asset price weakness are causing some to favour more conservative and defensive type funds.

Download the report

For a deeper dive, download the full Investing Insights report for June 2022 [PDF, 1.62 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 800,000 investors