Investing Insights with Tony Alexander: Is property making a comeback?

In August’s report, independent economist Tony Alexander finds investors are stepping up their asset-buying plans while residential property creeps back into the mix.

Each month, Tony surveys over 28,000 Kiwis to find out what they’re investing in and how they’re investing in it. He then analyses their responses and reports on how investment preferences are changing over time. This gives us a look into people’s thoughts on different shares, types of property, active vs passive fund management, whether to use an advisor or an app, which countries to invest in, and much more.

Below, we look at some of the key trends in Tony’s August survey.

Adding to assets

The proportion of investors planning to add to their portfolios is at a six month high, with 75% of respondents thinking about investing more in the coming year. That’s up from 71% last month and a notable increase on June’s low of 69%.

Back in June, wholesale interest rates were climbing as central banks zeroed in on inflation with aggressive monetary tightening. This, combined with broader concerns about a global slowdown, weighed on share market sentiment.

These concerns haven’t totally vanished. However, medium-to-long-term interest rates have eased on growing confidence that inflation—while still very high—will fall away quickly through 2023 and into 2024.

Hot property?

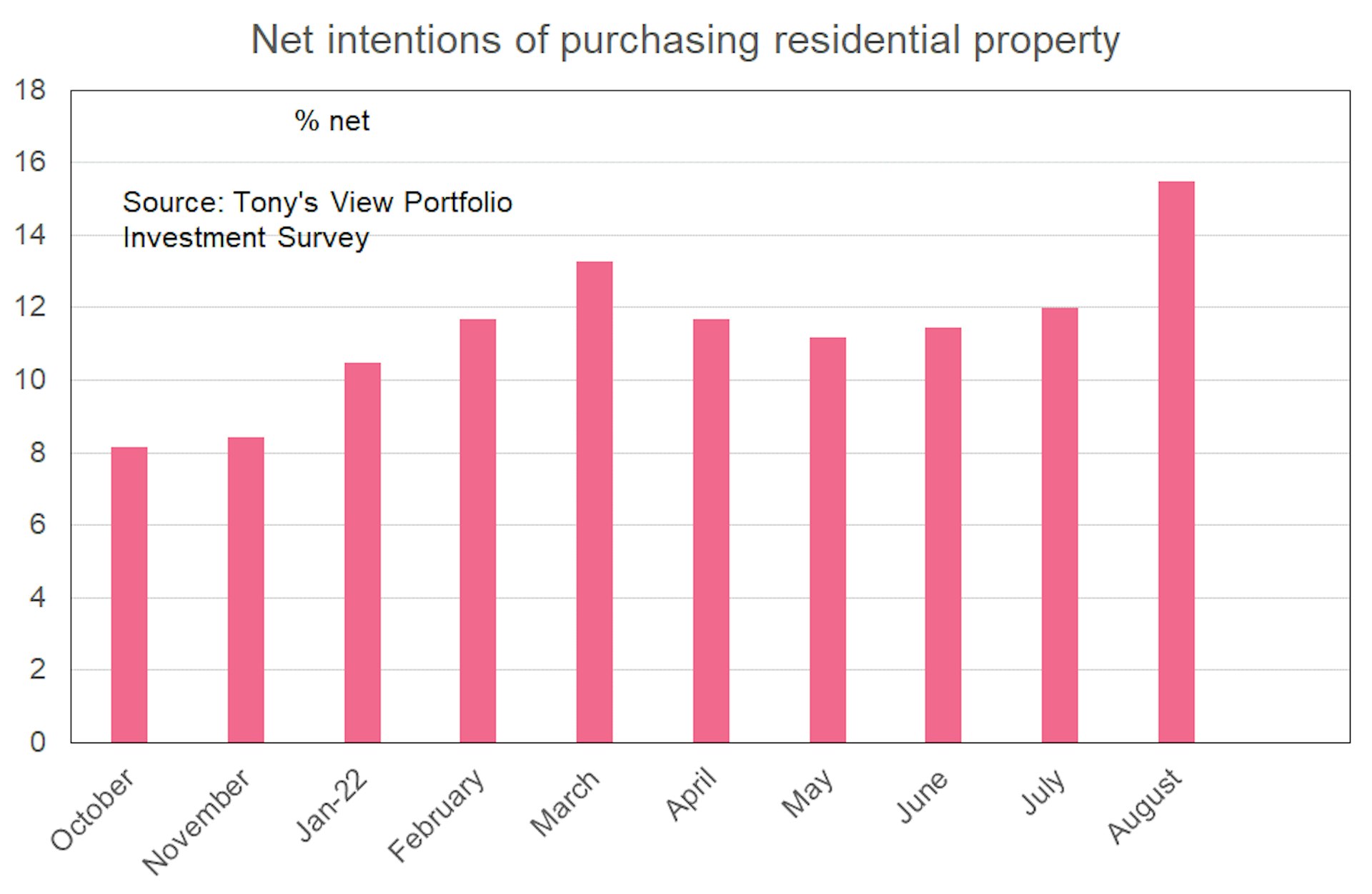

Interest in buying residential property is at its highest level since the survey began in October 2021. A net 16% of respondents plan to purchase property, up from 12% last month.

The apparent shift in sentiment could reflect easing fixed mortgage rates, signs of improved access to bank finance, recent house price falls, as well as a shift in political opinion polls (the opposition party has indicated, if elected, it would change some recently introduced housing-market policies, like the brightline test and the removal of interest expense deductibility).

Despite this, respondents’ future investment plans remain firmly in favour of shares, managed funds and/or exchange-traded funds (ETFs), with over 80% (net) of investors expressing interest in buying these asset classes.

The bold type

Respondents who are considering investing in managed funds continue to overwhelmingly prefer growth or aggressive styles. Interest in conservative or defensively-positioned funds has dropped further from its June high.

Mind the gap

The proportion of respondents who intend to invest in shares via a KiwiSaver scheme rather than through a non-KiwiSaver managed fund has climbed to 14%—its highest reading since the survey began last year.

Interest in investing in non-KiwiSaver managed funds has also risen slightly this month. This continues to be the preferred option of the two, but the gap is closing.

Download the report

For a deeper dive, download the full Investing Insights report for August 2022 [PDF, 1.59 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You might lose the money you start with. If you require financial advice, you should consider speaking with a qualified financial adviser, or seek independent legal, taxation, or other advice when considering whether an investment is appropriate for you. Past performance is not a guarantee of future performance. This content is brought to you by Sharesies Limited (NZ) in New Zealand and Sharesies Australia Limited (ABN 94 648 811 830; AFSL 529893) in Australia. It is not financial advice. Information provided is general only and current at the time it’s provided, and does not take into account your objectives, financial situation, and needs. We do not provide recommendations. You should always read the product disclosure documents available from the product issuer before making a financial decision. Our disclosure documents and terms and conditions—including a Target Market Determination and IDPS Guide for Sharesies Australian customers—can be found on our relevant NZ or Australian website.

Join over 930,000 customers