Investing Insights with Tony Alexander: Riding the ups and downs

Every three months, Tony surveys more than 30,000 Kiwis to find out what they’re investing in, how they’re investing, what they're selling, and what’s been on their minds. He then looks at how these preferences are changing over time and why.

Below, we look at some of the key trends from Tony’s November survey.

Quiet optimism

Investors appear to be feeling more settled post election. However, there are several factors still playing on investors’ minds like inflation, higher interest rates, the state of the economy, and geopolitics.

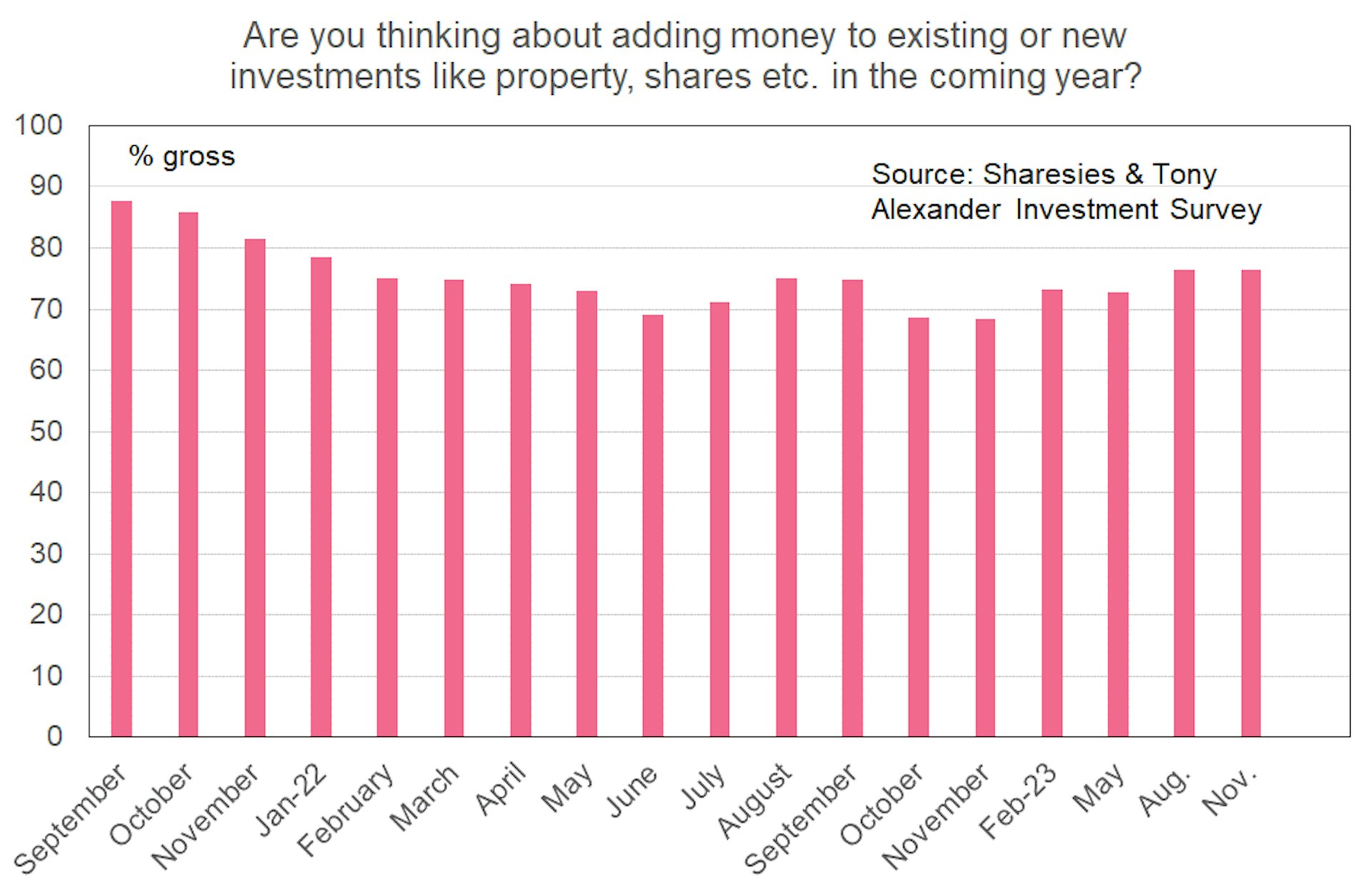

Investors’ willingness to add to their investments is down slightly at 76%, from a net 77% in August. This number remains quite a bit higher than it was this time last year (where it sat below 70%).

Interest in property is turning

Buying shares is the most favoured investment, with a net 58% of respondents planning to buy more in the future. There’s also an appetite for depositing or leaving funds in savings accounts and paying down debt.

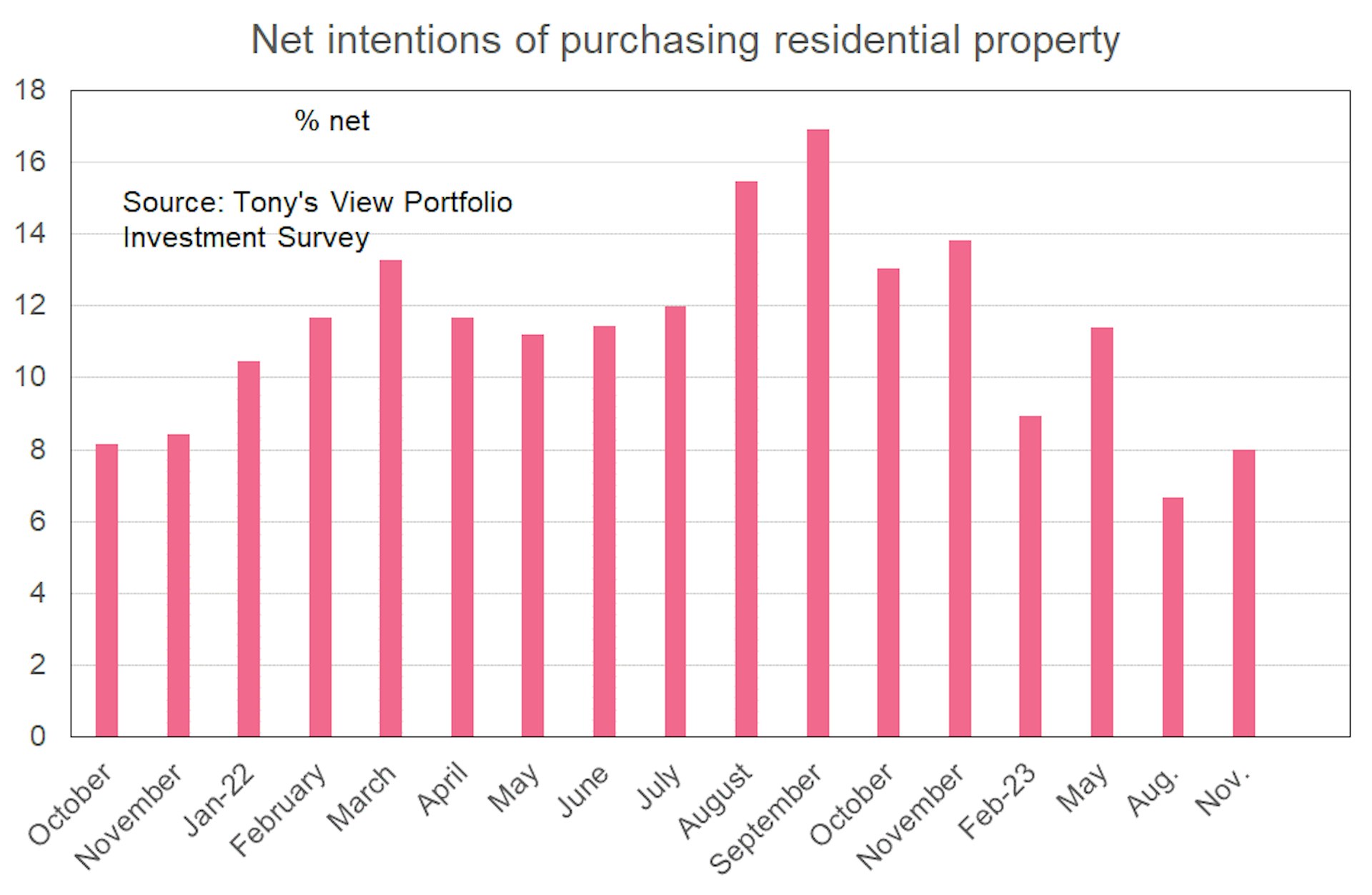

Intentions to buy residential property have risen this quarter, but it’s too early to tell if this trend will be sustained. One factor that could influence this is if the new government decides to make property-related tax changes.

It’s a different story for commercial property, which is continuing to decline in popularity. This is likely due to several things such as rising interest rates affecting property valuations, lower revaluations post the pandemic, and weaker economic activity whereby fewer businesses are looking to lease property.

All that glitters is gold

After declining throughout 2022, intentions to buy crypto assets have plateaued this year (generally sitting around a net 4% of survey respondents) with prices for some cryptocurrencies recovering slightly.

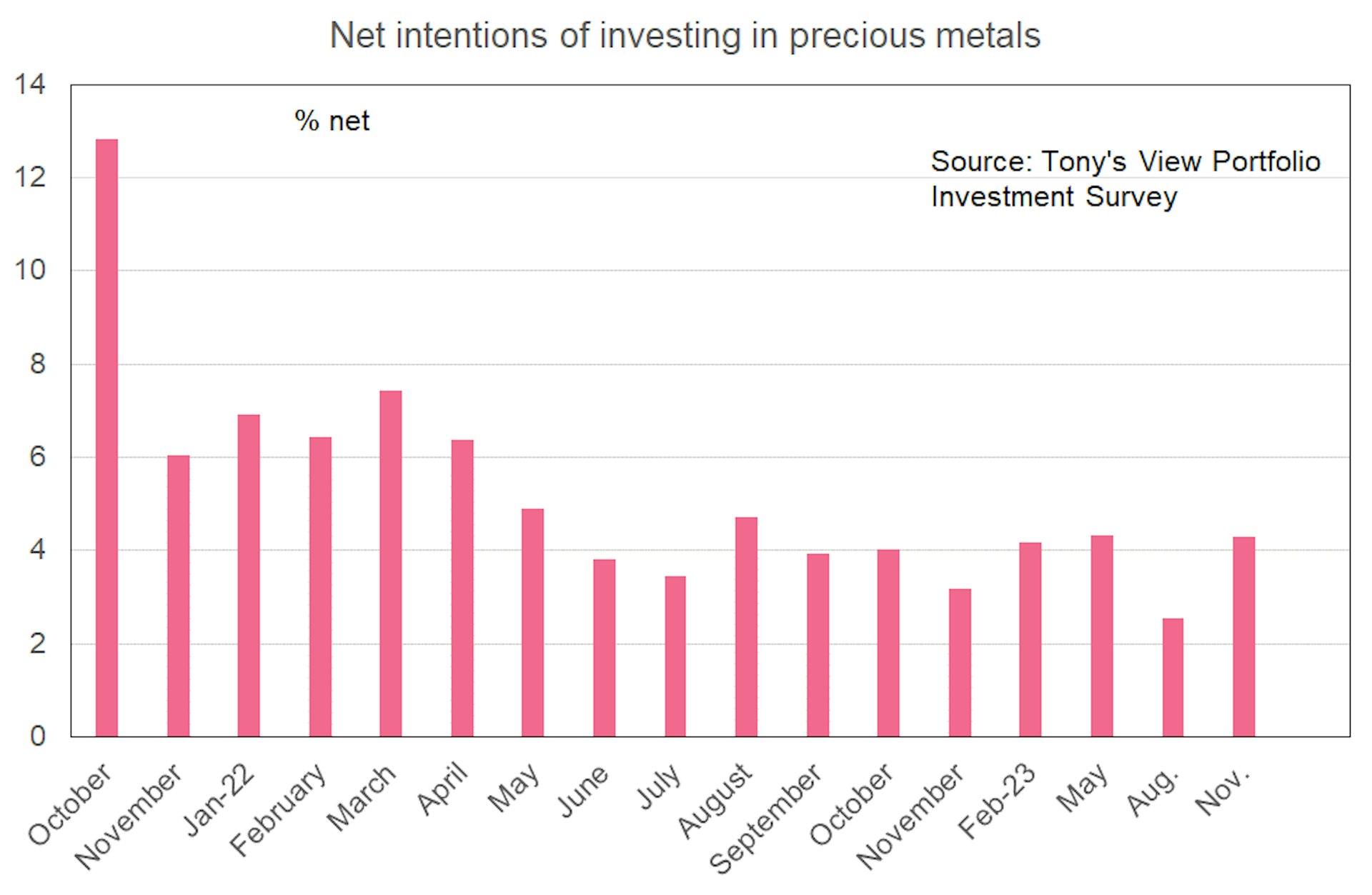

Also, plans to invest in precious metals have recovered after falling in Tony’s August survey.

Emotional roller coaster

People’s worries about their investment returns have been on a roller-coaster ride through 2023. The year started with a net 12% of respondents saying they were less concerned. This reading got better, then worse, and now is slightly better again. Perhaps this means people are looking through the current bout of global uncertainty, but holding off on some risky asset buying.

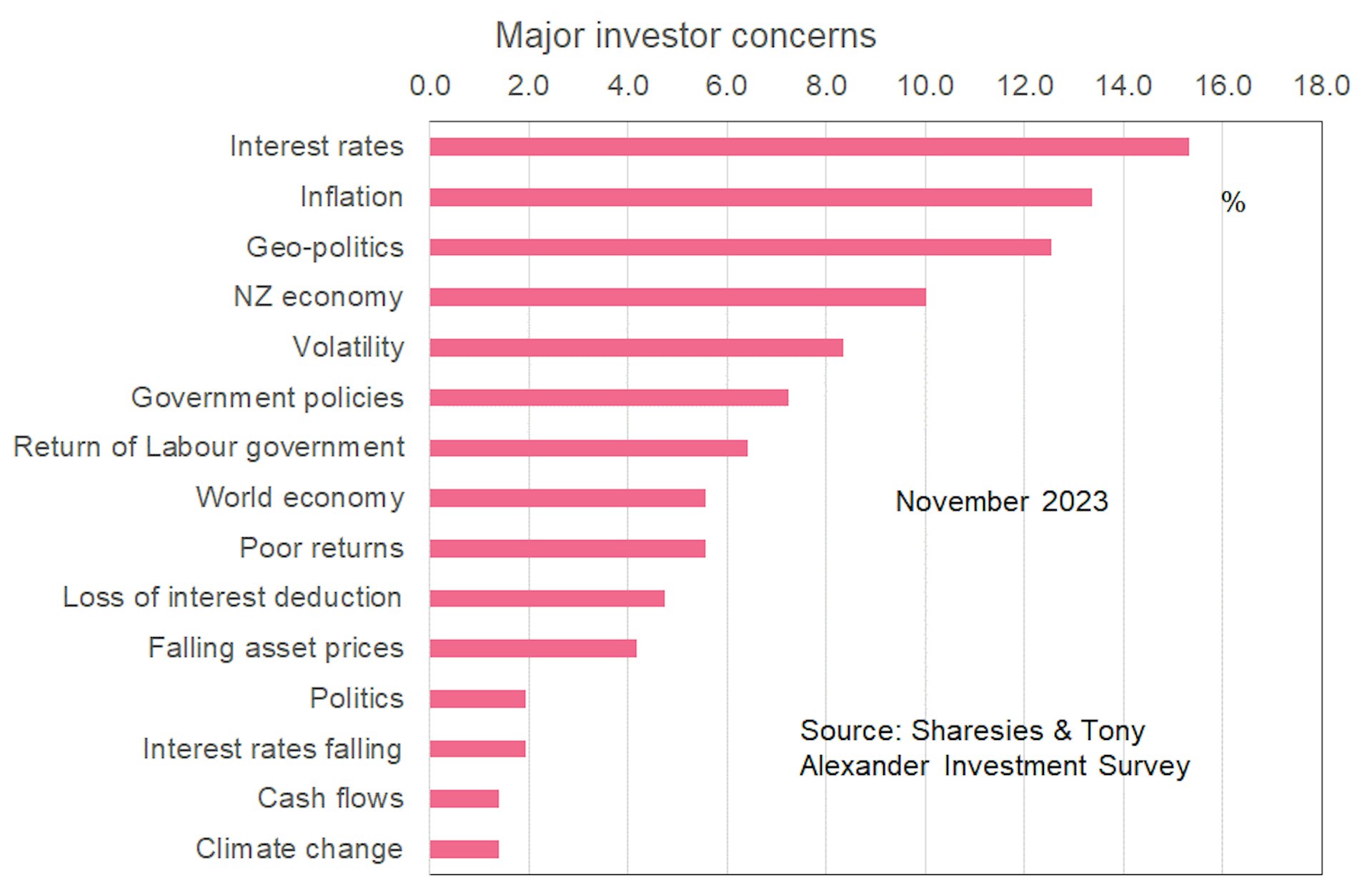

Top of the list of concerns is high-interest rates, followed by inflation, then global geopolitics (including the Middle East, Ukraine, and Taiwan).

Download the report

For a deeper dive, download the full Investing Insights report for November [PDF, 1.06 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 800,000 investors