Investing Insights with Tony Alexander: Shares go the distance

Every three months Tony surveys more than 30,000 Kiwis to find out what they’re investing in, how they’re investing, what they're selling, and what’s been on their minds. He then looks at how these preferences are changing over time and why.

Let’s look at some of the key trends from Tony’s August 2023 survey.

Steady as she goes

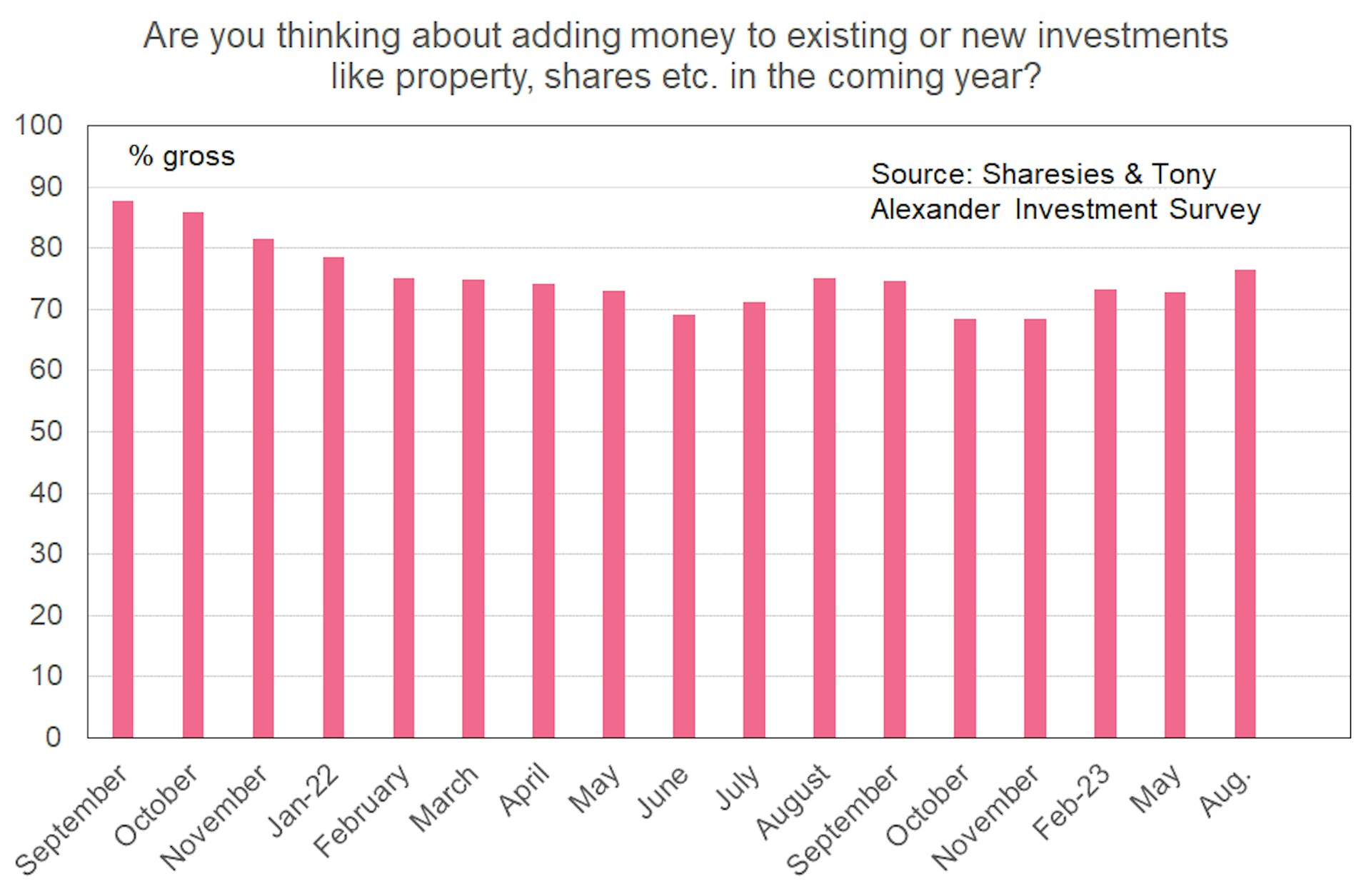

There was a slight rise in people saying they intend to invest more over the coming year. 77% of survey respondents answered this way, up from 73% in May, and the strongest result since November 2021.

This could be due to a number of reasons, such as the recent gains in offshore share markets (some saying that interest rates have peaked in Aotearoa) and improving business confidence.

Shares still on top

In August, shares remained the top investment survey respondents are intending to buy, followed by savings accounts, managed funds and exchange-traded funds (more shares), then residential property.

Just 22% of respondents are intending to invest in residential property (down from 25% in May), compared to 60% who are intending to buy shares.

In the following graph, intentions to buy are combined with intentions to sell, to calculate survey respondents' net purchasing trends.

Pumping the breaks on property

Intentions to invest in residential property are at their lowest since our survey started in October 2021.

Survey respondents' intention to invest in commercial property is also on a downward trend. This could be a result of the high-interest rate environment—which makes it more expensive to borrow—and from falling property valuations.

Savers buy time

In contrast to property, the intention to put money into a savings account continues on an upward trend—likely due to the high interest rates that banks (and saving providers like Sharesies) are currently able to offer.

As for other investment types, intentions to invest in crypto have flattened this quarter, intentions to pay down debt remains about the same, and intentions to invest in precious metals has decreased slightly.

What’s on investors’ minds?

Each survey, respondents are asked what’s causing them concern for their returns in the next one to two years. For August, the top concern regards the current government and politics—likely due to the fast-approaching general election. This is followed by interest rates, inflation, market volatility, and the New Zealand recession.

Compare this with six months ago, where the greatest concern was inflation, followed by the recession, and rising interest rates.

Investors consider using AI

For the first time, survey respondents were asked if they’ve used artificial intelligence to select shares. Just 1.1% of respondents have used it, but 12.7% indicate they’d consider doing so in the future. It will be interesting to see how this tracks next quarter!

Download the report

For a deeper dive, download the full Investing Insights report for August [PDF, 1.01 MB].

Investing Insights is conducted in partnership with Tony Alexander. All analysis is Tony’s and not influenced by Sharesies.

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 800,000 investors