Some investment strategies to get you started

There are lots of different investment strategies. Some people like to go deep on companies’ annual reports, some people like to read a share price chart, and some people like more set-and-forget approaches. And of course, there are all kinds of approaches and strategies in between.

Dollar-cost averaging

This is an old favourite that we’ve been talking about for a long time now—but we’ll refresh your memory anyway.

How it works

Dollar-cost averaging is when you choose a group of investments, and consistently invest the same amount on a regular basis, regardless of what the price is.

Why investors use this approach

The main advantage of this approach is that it can “smooth out” the ups and downs of the share market. If you’re investing every week, you might get a bargain in one week, then pay a slightly higher price the next week, then get something in between in your third week. This doesn’t really matter as long as the overall trend is in the right direction. So dollar-cost averaging is great if you’re investing for the long term, and don’t want to try and time the market to get a bargain.

The tradeoffs

The main tradeoff with dollar-cost averaging is that you miss out on the potential upsides of trying to buy at the right time. If you hold onto your money until you think a share’s price is lower than it should be, you can get some really solid returns if you’re right—but if you’re wrong, it’s going to cost you. Timing the market has also proven to be very difficult over the long term! Dollar-cost averaging sacrifices the opportunity for the bigger upsides, in exchange for less exposure to the downsides.

Blue chip approach

A blue chip company is an established public company that is reasonably stable and has a strong record of steady growth—sometimes going back decades or more! On the NZX, the major banks are blue chip companies, as are the major utilities like Spark.

How it works

A blue chip approach is exactly what it sounds like! It’s investing a portion of your portfolio in these companies.

Why investors use this approach

A blue chip approach gives you a piece of companies that are stable, have proven track records, and are highly liquid (meaning there’s lots of shares being bought and sold every day). It’s especially useful if you’re investing for the long term, because they tend to grow over time, and often deliver consistent dividends.

The tradeoffs

The downside of this approach is that you may miss out on some higher-risk growth opportunities. But remember, there’s nothing stopping you from following a blue chip approach with some of your portfolio, and a different approach with different bits of your portfolio.

Another downside of this strategy is that “blue chip” doesn’t mean “sure thing.” Blue chip companies can lose value, and they can even (rarely) go bust, like Lehman Brothers in 2008.

The risk of this kind of thing happening to you depends on how diversified you are, and how much you dollar-cost average. Investing all your money in one blue chip company is higher risk than investing in a selection of blue chip companies, and investing all at once is often higher risk than investing on a regular basis.

Fundamental analysis

Fundamental analysis is exactly what it sounds like: investing in companies based on the fundamentals of how those companies are performing.

With fundamental analysis, it’s important to remember that the best anyone can do is make an educated guess. You’ll never be able to predict a company’s future with 100% certainty. So lots of fundamental investors hedge these educated guesses by staying diversified as well.

How it works

Fundamental analysis involves a lot of looking at annual reports, reading up on a company’s competitors and getting familiar with some key metrics like income, revenue, cash flow and market capitalisation. You use these numbers to try and figure out if a share currently costs more or less than it’s actually worth. If you think it costs less than it is worth, then it makes sense to buy it—after all, if it’s worth a certain amount, you should eventually be able to sell it for that amount, once other people figure it out.

This is a great way to practice your business and finance skills...or build these skills up from scratch!

Why investors use this approach

Investors use fundamental analysis when they think their analysis is telling a different, more accurate story than the one the rest of the market is hearing. When investors buy shares based on fundamental analysis, they’re essentially saying that they think a company is underpriced right now, and will be worth more in the future. If you’re doing fundamental analysis, you can make this decision based on just a few metrics, or based on hours and hours of research. It’s up to you because, after all, you’re the one making the investment.

The tradeoffs

The main tradeoff with fundamental analysis is that you are making a bit of an educated guess. To succeed at fundamental analysis, you have to be correct about how much some shares are worth when the rest of the market is wrong. After all, if you think some shares should be worth $5, but they’re only trading for $3, you’re telling everyone buying and selling those shares that they’re doing so at the wrong price.

Technical analysis

Technical analysis is really different from fundamental analysis. People following technical analysis are trying to time the market—they want to buy when things are about to go up, and sell when things are about to go down. This is really hard, and people often get it wrong.

How it works

People who follow a technical analysis approach don’t bother with things like annual reports or market research. Rather, they only look at two things: the share’s price over time, and how many shares have been traded over time. Then, they try to find patterns in these two figures to signal an investment’s strength or weakness.

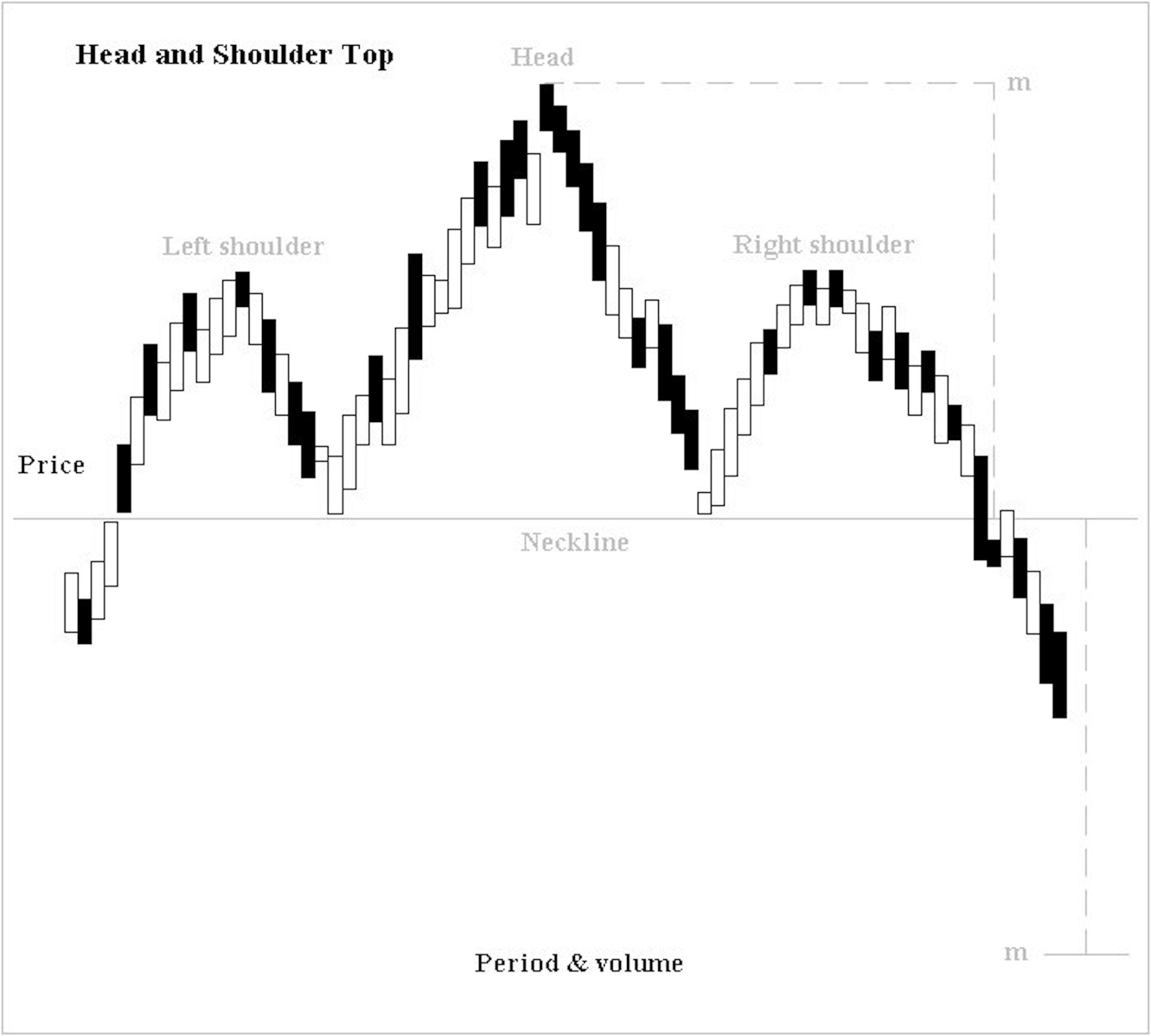

You’ll hear technical analysts talk about things like “support” (when a share’s price is heading down), “resistance” (when a share’s price is heading up) and “head and shoulders”, which looks like this:

Why investors use this approach

Investors who use technical analysis are saying that they think past movements in a share’s price are a good predictor of future movements. If they’re right, they get rewarded with solid returns.

The tradeoffs

The main tradeoff here is that you are trying to time the market perfectly. What’s more, you’re trying to time the market based only on what the share’s price has done in the past—this is not usually a guarantee about what it will do in the future. There’s no set of rules or anything dictating that share prices have to follow a certain pattern.

Making a choice

Now that you have an idea of some of the different approaches, you can make a choice around which one (or combination) best suits you. And remember, you can manage your risk by making sure you’re diversified. If you have a well-diversified portfolio, little ups and downs and small failures in parts of it have less of an impact, particularly while you are building that confidence.

So it’s really all about what you want: your risk tolerance, your time horizon, and how much time you want to devote to investing. It’s up to you!

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

Join over 800,000 investors