How do I make money from investing in shares?

When you’re investing, even for the long term, you have one main goal: to make money. We’ve had a lot of questions asking exactly how you do this, so we thought we’d get into the details.

First, an overview

There are two ways you can make money from investing:

Capital gain: selling your investments for more than you paid for them

Dividends: getting income from your shares

There’s also two ways you can lose money, and they’re pretty similar. One is that you sell your investment for less than you paid for it. The other is if the value of your investment drops to $0, and you don’t get a chance to sell it at all (this is pretty rare but does happen!).

But let’s get into some more details.

The capital gain

To get a capital gain, two things need to happen. First, your shares need to be worth more than you paid for them. Second, you need to sell those shares. That’s how you change a “paper gain” into a capital gain—or, cash. For example, if you buy some shares for $5, then sell them later on for $7, you’ve made a capital gain of $2.

This means that the value of your shares can change day to day, but your realised capital gain is fixed at the moment you sell your shares. If the price of your shares change, but you don’t sell them, you haven’t really made or lost anything.

The last thing about capital gains is that they’re a one-off. If you buy your shares for $3, then sell them for $5, you’ve made $2—but that’s all you’re going to make because someone else has your shares now. This is a good reason to try and invest for the long term. While it can have its ups and downs in the short term, over time, investment markets do tend to grow in value. Generally speaking, the longer you can hold out, the higher the chance is that you’ll make more money when you eventually sell!

But you might want to make some income along the way. That’s where dividends come in.

The details on the dividends

Sometimes, when a company makes a profit, it will choose to give some of that profit back to its owners—that’s you. These are paid in cash (as in, you don’t have to sell anything), and they usually happen a couple of times a year.

They’re generally paid based on how many shares you owned or purchased the day before a particular date (that’s the ‘ex-dividend date’). If you had one share in a fund that gets a dollar per share from the companies it invested in, then you get a dollar. If you had a thousand shares, then you’d get a thousand dollars. And so on, and so forth.

A really important point to remember about dividends is that they aren’t mandatory. Companies will often choose to reinvest their profits, rather than give them directly to shareholders. When they do this, the idea is to increase the capital gain (by making the company more valuable), rather than give the money to you directly. Amazon is one of the most valuable companies in the world, and it doesn’t pay dividends!

In Sharesies, you can see how much a company or fund has paid in dividends over the past year by looking at the “how you can make money” bit.

For example, Spark has a dividend yield of around 8%. That means that Spark paid around 8% in dividends in the last year. That may not seem like much, but remember that it’s 8% in cash, every year, without you having to sell anything.

On the other hand, you need to remember that dividend yield is based on information from the past. Things may be different next year, as every company will make different amounts of money, and make different decisions about whether to pay dividends and how high those dividends should be.

Losing money

Now let’s take a look at the other side: losing money. The most common way you can lose money is if you sell your shares for less than you paid for them. This is really important because shares go up and down in value all the time. So if you buy shares for $10, and they drop in value to $8, you may feel like you’ve lost $2—but you’ve actually lost nothing, unless you sell. Once you sell, you’re turning that “paper loss” into a real loss.

Another way of thinking about this is to remind yourself that the number of shares you own doesn’t change until you buy or sell. If you spent $10 on 10 shares for a dollar each, you still have 10 shares, no matter what happens to the price. Reminding yourself of this is a good way to help you stick to your strategy and stay cool in the long term if the market’s going up and down. Diversification can also help reduce risk over time!

What to do?

So now that you have a good understanding of the two ways to make money with shares, which approach is best? That’s the great news—you don’t have to choose one or the other (although you can if you want). But if you want to have it both ways, there’s nothing stopping you from investing some of your money in investments that pay more dividends, and some in investments that tend towards capital gains.

Diversifying like this gives you some ongoing income to reinvest, or spend, while also giving you access to longer-term capital gains. You really can have it all!

Ok, now for the legal bit

Investing involves risk. You aren’t guaranteed to make money, and you might lose the money you start with. We don’t provide personalised advice or recommendations. Any information we provide is general only and current at the time written. You should consider seeking independent legal, financial, taxation or other advice when considering whether an investment is appropriate for your objectives, financial situation or needs.

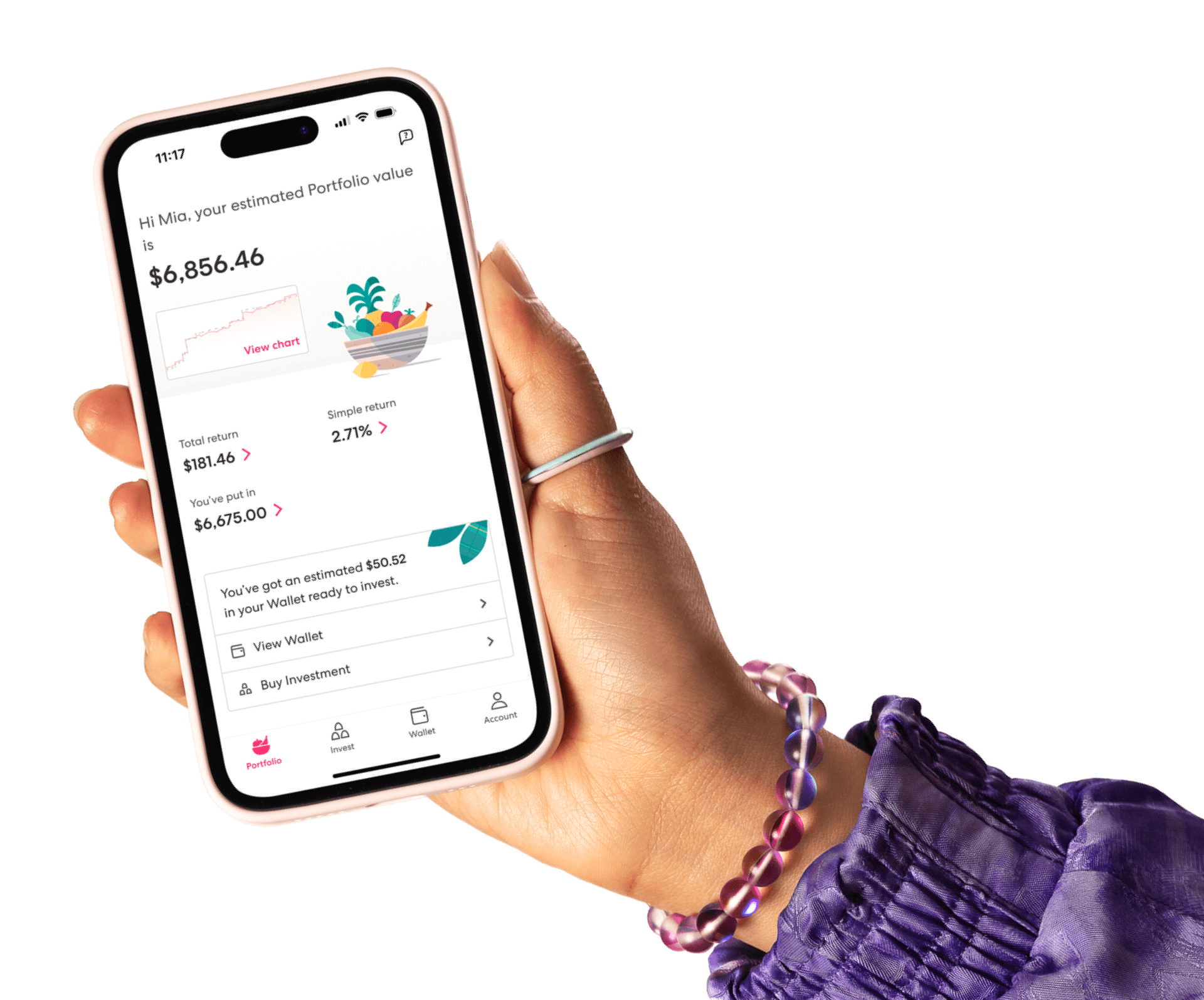

Join over 700,000 investors